The Tata Motors-Iveco Story: How a $4.5 Billion Deal Could Reshape Global Commercial Mobility

Picture this: it’s a sweltering summer day in Mumbai, and Ratan Tata’s successor is about to pull off what might become the most strategic automotive acquisition since, well, Tata’s own Jaguar Land Rover coup back in 2008. On July 30, 2025, as news broke of Tata Motors’ audacious $4.5 billion bid for Italian truck giant Iveco, the automotive world collectively held its breath. This wasn’t just another corporate transaction it was a potential game-changer that could redraw the map of global commercial vehicle manufacturing.

The Deal That’s Got Everyone Talking {#the-deal}

Let’s cut straight to the chase: Tata Motors is reportedly acquiring Italian commercial vehicle manufacturer Iveco from the Agnelli family’s Exor for $4.5 billion, making it the company’s largest-ever automotive acquisition. This deal dwarfs even their celebrated $2.3 billion Jaguar Land Rover purchase and stands as the Tata Group’s second-largest acquisition after the infamous Corus steel deal.

The transaction structure is fascinating in its complexity. Tata Motors plans to first acquire a 27.1% stake from Exor, followed by a tender offer for the remaining shares through a Dutch subsidiary. What makes this particularly intriguing is that Iveco’s defense operations representing about 13% of the company’s EBIT will be spun off separately, likely to Italian defense contractor Leonardo SpA. It’s a strategic masterstroke that addresses Italy’s “golden power” concerns while allowing Tata to focus purely on the commercial vehicle goldmine.

Meet the Players: A Tale of Two Giants

Tata Motors: The Indian Powerhouse

Imagine a company that produces both the world’s cheapest car (the $2,500 Nano, though discontinued) and owns luxury British marques like Jaguar and Land Rover. That’s Tata Motors in a nutshell a study in contrasts and ambition. With a commanding 32.53% share of India’s commercial vehicle market, Tata Motors isn’t just a local player; it’s the undisputed king of Indian roads.

But here’s where it gets interesting: while Tata dominates domestically, earning 90% of its commercial vehicle revenue from India, the company has been quietly nurturing global ambitions. Their Fleet Edge telematics platform now connects over 500,000 commercial vehicles, providing real-time insights that help fleet operators optimize everything from fuel consumption to driver behavior. It’s the kind of digital transformation that positions Tata not just as a truck manufacturer, but as a mobility solutions provider.

Iveco: European Engineering Excellence

Now, let’s hop across continents to Turin, Italy, where Iveco has been crafting commercial vehicles since 1975. Don’t let their relatively modest 12.5% European market share fool you—Iveco punches well above its weight in specific segments. They command an impressive 50.5% of Europe’s intercity bus market and are making serious inroads into electric commercial vehicles.

Iveco’s strengths lie in three key areas: European engineering excellence, a robust presence in Latin America (where they derive significant revenue), and cutting-edge technology in electric and hydrogen fuel cell vehicles. Their recent partnerships with Stellantis for electric van commercialization and their focus on sustainable transport solutions position them perfectly for the industry’s green transition.

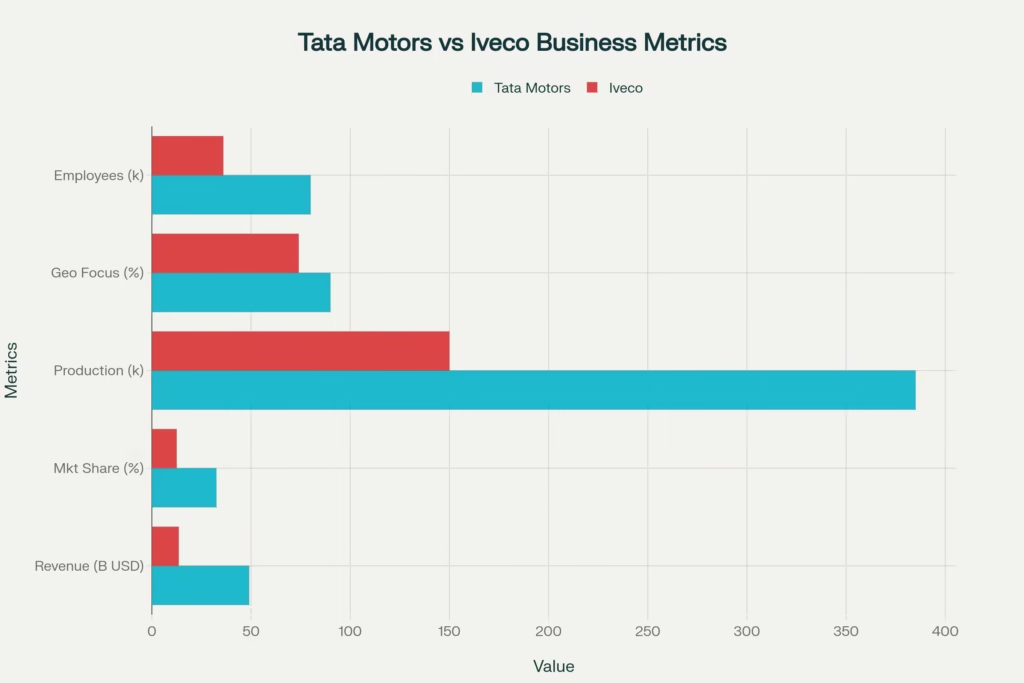

Tata Motors vs Iveco: Key Business Metrics Comparison

The Strategic Fit: Why This Marriage Makes Sense {#strategic-motives}

Geographic Synergies: Filling the Gaps

Here’s where the magic happens. Tata Motors brings massive scale in India and growing presence in Asia, while Iveco offers established European operations and Latin American networks. It’s like two puzzle pieces that were always meant to fit together. Tata gets instant access to Europe’s sophisticated commercial vehicle market, while Iveco gains entry into India’s rapidly growing economy and Tata’s expanding Asian footprint.

Technology Transfer: The Real Gold Mine

But geography is just the beginning. The technology synergies are where this deal gets truly exciting. Iveco brings Euro VI emission standards expertise critical as India transitions to stricter emission norms. Their electric and hydrogen fuel cell technology could accelerate Tata’s green transition, while Tata’s cost-effective manufacturing and digital solutions like Fleet Edge could revolutionize Iveco’s operations.

Consider this: Iveco’s industrial business is projected to generate €400-450 million in free cash flow in 2025. Combined with Tata’s operational efficiency and scale, we’re looking at potential synergies that could reshape both companies’ profitability profiles.

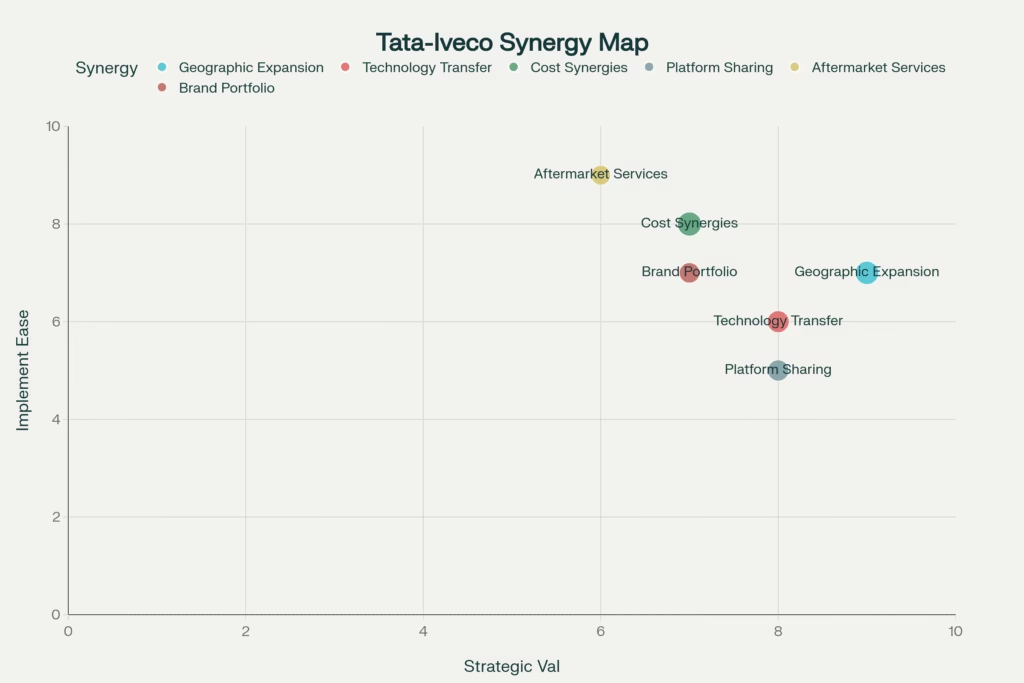

Tata Motors-Iveco Acquisition: Strategic Synergies Analysis

Expected Synergies: The $4.5 Billion Question {#synergies}

Platform Modularity: The Future of Vehicle Design

One of the most underappreciated aspects of this deal is the potential for modular platform design. Modern commercial vehicles are increasingly built using modular approaches—think of it as automotive LEGO blocks that can be mixed and matched to create different vehicle variants efficiently.

Tata’s experience with cost-effective modular design combined with Iveco’s European engineering standards could create platforms that serve both mass-market Indian needs and premium European requirements. This isn’t just about cost savings; it’s about creating a flexible foundation for future innovation.

Aftermarket and Digital Solutions: The Recurring Revenue Dream

Here’s something that doesn’t get enough attention in M&A discussions: aftermarket services. Tata’s Fleet Edge platform, which connects over 500,000 vehicles, represents a goldmine of recurring revenue and customer stickiness. Imagine combining this with Iveco’s European service network you’d create one of the world’s most comprehensive commercial vehicle service ecosystems.

The numbers are compelling: Fleet Edge users report savings of up to ₹1.56 lakh per truck annually through optimized operations. Scale that across Iveco’s European customer base, and you’re looking at massive value creation potential.

Industry 4.0 and AI Integration

The automotive industry is undergoing a digital revolution, and this merger positions the combined entity at the forefront of Industry 4.0 implementation. Tata’s digital expertise combined with Iveco’s European automation standards could create smart factories that respond in real-time to market demands.

Integration Challenges: The $4.5 Billion Headache {#integration-challenges}

Cultural Integration: East Meets West

Let’s be honest merging an Indian conglomerate with an Italian automotive company isn’t going to be a walk in the park. Different business cultures, operating procedures, and market expectations create complex integration challenges. Tata’s previous experience with JLR provides a template, but Iveco operates in the more complex commercial vehicle space with different customer dynamics.

Regulatory Hurdles: Navigating the Golden Power Maze

Italy’s “golden power” laws add another layer of complexity. The Italian government has already signaled support for separating Iveco’s defense operations, but ongoing regulatory scrutiny could impact integration timelines. Tata will need to demonstrate that the acquisition serves Italian strategic interests while avoiding the kind of regulatory backlash that derailed Chinese acquisition attempts.

Technology Integration: The Devil’s in the Details

Integrating different ERP systems, manufacturing processes, and quality standards across continents is a monumental task. Post-merger integration studies show that 70-90% of M&A transactions fail, often due to integration challenges. Tata’s track record with JLR suggests they’ve learned valuable lessons, but the commercial vehicle industry presents unique operational complexities.

Market Impact: Reshaping the Global Landscape {#market-impact}

European Market Dynamics

This acquisition could significantly alter Europe’s commercial vehicle competitive landscape. Currently dominated by Volvo, Daimler, and MAN, the market might see a new player with the scale and cost advantages to challenge established order. Tata’s ability to leverage Indian cost structures while maintaining European quality standards could create pricing pressures across the industry.

Indian Market Evolution

In India, the deal strengthens Tata’s already dominant position while bringing advanced technology that could accelerate the market’s evolution toward Euro VI standards and electric vehicles. This timing is perfect as India’s commercial vehicle market is expected to grow significantly driven by infrastructure development and e-commerce expansion.

Latin American Opportunities

Often overlooked, Latin America represents a significant growth opportunity. Iveco already has an established presence in the region, while Tata brings cost-effective manufacturing that could compete effectively with Chinese manufacturers. The combined entity could become a formidable player in this emerging market.

Future Trends: Industry 4.0 and Intelligent Fleets {#future-trends}

Electrification and Hydrogen: The Green Revolution

The commercial vehicle industry is at an inflection point. European regulations mandate significant emission reductions, while hydrogen fuel cell technology is gaining traction for long-haul applications. Iveco’s partnerships in electric vehicles and hydrogen technology, combined with Tata’s scale, could accelerate the development of clean commercial vehicles.

Autonomous Driving and Connected Fleets

The future belongs to connected, autonomous fleets that optimize routes, predict maintenance needs, and reduce operational costs. Tata’s Fleet Edge provides a foundation, while Iveco’s European technological partnerships could accelerate autonomous vehicle development.

TaaS: Transportation as a Service

We’re moving toward a world where mobility becomes a service rather than an asset ownership model. The combined Tata-Iveco entity, with its digital platforms and service networks, is well-positioned to lead this transformation.

The Broader Industry Context: A Consolidating Market

Chinese Competition: The Elephant in the Room

Let’s address the elephant in the room: Chinese manufacturers like Sinotruk, FAW, and BYD are aggressively expanding globally. This Tata-Iveco merger can be seen as a defensive move to create scale that can compete effectively with Chinese cost advantages while maintaining technological sophistication.

M&A Trends in Automotive

The automotive industry is consolidating rapidly, with 472 transactions recorded globally in 2024 the highest since 2020. This trend reflects the industry’s need to achieve scale for R&D investments in electrification, autonomous driving, and digital transformation.

Regulatory Landscape Evolution

Emission standards are becoming increasingly stringent globally. Euro VI standards in Europe, similar regulations in India, and the push toward zero-emission vehicles create opportunities for companies with the right technological capabilities. The Tata-Iveco combination addresses these regulatory challenges comprehensively.

What This Means for Stakeholders

Fleet Operators: Enhanced Value Proposition

Fleet operators stand to benefit significantly from this merger. The combination of Tata’s cost-effectiveness and digital solutions with Iveco’s European quality and service network could reduce total cost of ownership while improving operational efficiency.

Suppliers: Consolidation and Opportunities

The automotive supply chain will likely see consolidation as the merged entity rationalizes supplier relationships. However, suppliers with innovative technologies, particularly in electrification and digitalization, could see expanded opportunities.

Competitors: Time to Respond

Other commercial vehicle manufacturers will need to respond to this new competitive threat. We might see accelerated consolidation as companies seek scale to compete effectively.

Frequently Asked Questions

How will this deal affect Tata Motors’ demerger plans?

The acquisition is likely to strengthen the commercial vehicle division ahead of its planned demerger from passenger vehicles. A stronger, more global CV business would be more attractive as a standalone entity.

What about employment and manufacturing locations?

Based on Tata’s previous acquisitions, we can expect preservation of existing employment with potential expansion. Tata has historically maintained acquired companies’ operations while adding manufacturing capacity.

How does this compare to the JLR acquisition?

Unlike JLR, which was a distressed asset, Iveco is a profitable business with positive cash flow. This suggests a potentially smoother integration process with less restructuring required.

The Road Ahead: Challenges and Opportunities

As we look toward the future, this $4.5 billion bet represents more than just an acquisition it’s a statement of intent. Tata Motors is positioning itself not just as an Indian success story, but as a global player capable of competing on the world stage.

The challenges are real: cultural integration, regulatory hurdles, and the complex task of merging operations across continents. But the opportunities are equally compelling: access to new markets, technological synergies, and the scale needed to compete in an increasingly consolidated industry.

Success will depend on execution something Tata has proven capable of with JLR, despite initial skepticism. If they can replicate that playbook while avoiding the pitfalls that derailed the Corus acquisition, this deal could indeed reshape the global commercial vehicle landscape.

The commercial vehicle industry stands at a crossroads, with electrification, autonomous driving, and digitalization transforming how goods move around the world. The companies that will thrive are those with the scale, technology, and global reach to navigate this transformation.

With this audacious move, Tata Motors isn’t just buying a company they’re buying a ticket to the future of global commercial mobility. Whether they can make the most of this opportunity remains to be seen, but one thing is certain: the commercial vehicle industry will never be quite the same again.

The Tata Motors-Iveco story is still unfolding, with regulatory approvals and integration challenges ahead. But as we’ve seen throughout automotive history, the biggest risks often lead to the greatest rewards. In a world where standing still means falling behind, sometimes the most dangerous move is not moving at all.

Keywords: Tata Motors, Iveco, commercial vehicles, automotive acquisition, $4.5 billion deal, truck manufacturing, European automotive market, Indian automotive industry, vehicle merger, commercial vehicle synergies, Fleet Edge telematics, Euro VI emission standards, electric commercial vehicles, hydrogen fuel cell technology, modular platform design, Transportation as a Service, TaaS, automotive consolidation, Industry 4.0, AI in automotive, aftermarket solutions, Italian automotive, global mobility, commercial fleet management, automotive M&A, vehicle electrification, autonomous driving, connected fleets, automotive technology transfer, emerging markets automotive, Latin America commercial vehicles, sustainable transport solutions, digital transformation automotive, smart manufacturing, automotive supply chain, vehicle integration challenges, regulatory compliance automotive, golden power laws Italy, commercial vehicle competition, Chinese automotive manufacturers, automotive innovation, fleet operators, automotive digitalization

Disclaimer: Transparency is important to us! This blog post was generated with the help of an AI writing tool. Our team has carefully reviewed and fact-checked the content to ensure it meets our standards for accuracy and helpfulness. We believe in the power of AI to enhance content creation, but human oversight is essential.